This translation was generated using artificial intelligence. We strive for accuracy and quality, but automated translations may contain errors. You can read the original text here.

Over the past five years, up to 5% of Belarus’s total population has left the country. That may not sound like much. But considering that most of those leaving are young, highly qualified professionals and families with children — and factoring in the broader economic challenges — migration has become one of the main obstacles to the country’s further economic development.

By Anastasiya Luzgina

At least 400,000 Belarusians — around 4.4% of the population — currently live and work outside the country. This estimate is based on data from the main directions of Belarusian migration.

Let’s start with the European Union. As of early 2025, about 250,000 Belarusians were permanently residing in EU countries. The actual number is likely higher. Some people who have been living continuously in the EU for more than 5–10 years may have already acquired citizenship. For example, those eligible for a Pole’s Card can go through the naturalization process in just a few years.

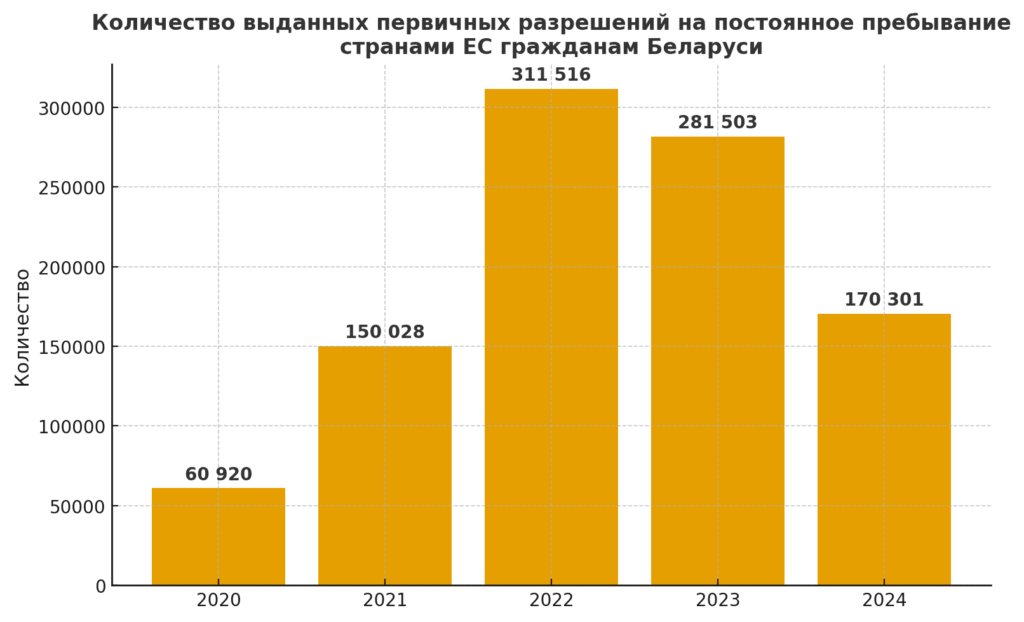

The number of initial residence permits issued by EU countries to Belarusian citizens

Belarusians also move to Russia either for work or permanent residence. However, Russia is currently not a particularly attractive destination for Belarusian migrants. According to Russian officials, data on Belarusians employed in the Russian labor market exists, but their number is negligible compared to the number of workers from Tajikistan and Uzbekistan. As of 2023, Belarusians accounted for about 2% of labor migrants — approximately 124,000 people. Another country that has attracted Belarusians is Georgia. As of January 1, 2025, around 12.8 thousand Belarusian citizens were living there. Let us now examine how migration slows down the economy.

Labor shortages, inflation, and slowing economic growth

One of the most evident negative consequences of Belarusians leaving the country has been a labor shortage in the job market. In some cases, when a country faces high unemployment, increased migration outflows can help stabilize the situation by balancing supply and demand for labor. But this clearly doesn’t apply to Belarus. In recent years, national statistics have consistently shown a decline in overall employment. Between 2018 and 2024, the Belarusian economy lost over 200,000 workers.

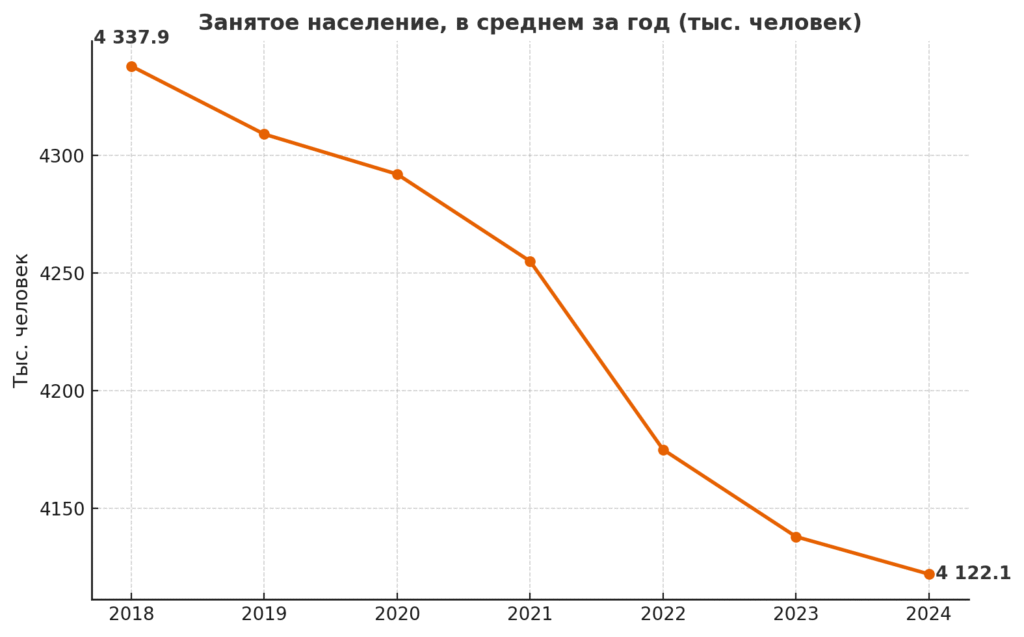

Employed population, annual average, thousand people

According to the International Labour Organization (ILO) methodology, the unemployment rate in Belarus has gradually declined, reaching 2.8% in Q1 2025, compared to 4.2% in 2019. However, a certain level of unemployment is normal for any economy—it can’t be zero, since some people are always switching jobs or searching for new ones. Very low unemployment may actually indicate a labor shortage, which is confirmed by the growing number of job vacancies.

As of October 2019, there were approximately 99,000 open positions, while by August 2025, the number had almost doubled to 200,000. A shortage of workers limits companies’ ability to scale up production, which in turn leads to slower GDP growth. In 2023–2024, Belarus’s GDP grew by 4% or more, but this was largely due to a post-crisis rebound following the economic downturn of 2022. In the first half of 2025, GDP growth slowed to 2.1%.

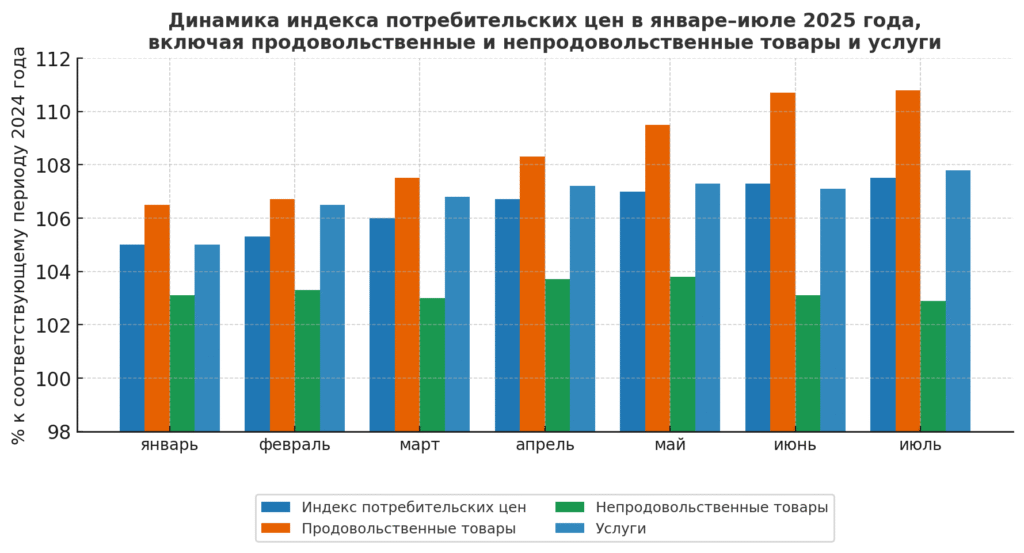

Competition for workers is pushing companies to raise wages. This is beneficial for workers in the short term, but in the medium term, when real wage growth outpaces productivity, it contributes to faster inflation.

In Belarus, the situation was distorted by artificially suppressed prices between 2022 and 2024, which undermined business efficiency. For example, the profitability of sold goods decreased, and if strict price controls had remained in place, it could have led to even lower margins and a rise in the number of unprofitable enterprises.

As a result, in spring 2025, the government eased price regulations, which triggered a spike in inflation. In June 2025, annual inflation hit 7.3%, with food prices seeing the highest increases.

Consumer price index dynamics in January–July 2025, including changes in prices for food and non-food goods and services, in % compared to the same period in 2024

Labor Shortages, Inflation, and Slower Economic Growth

Labor shortages in the economy were not the only factor, but they were an important one, contributing to the slowdown of GDP growth and the acceleration of inflation. Government attempts to attract foreign workers have not yet delivered the expected results. The 150,000 Pakistanis whose arrival had been discussed are in no hurry to come to Belarus. As of the first quarter of 2025, around 60,000 foreign specialists were working in the country — approximately 1.5% of the employed population — which does not resolve the labor shortage problem.

At the same time, by the end of 2024, more than 130,000 Belarusians were paying social security contributions in Poland alone.

Outflow of Highly Qualified Professionals

Another major concern for any country experiencing emigration is the departure of highly skilled professionals. Looking at data from Poland, around 78% of Belarusians residing there are aged 20 to 44 — meaning they are often young or well-established professionals who can remain active in the labor market for many years.

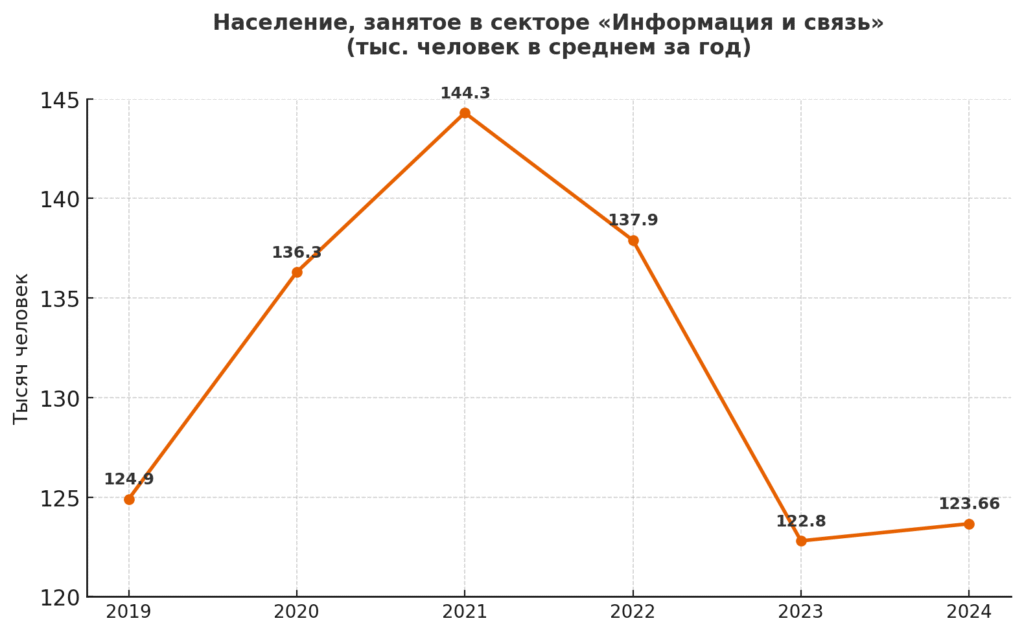

Over the past few years, Belarus has lost professionals from a wide range of fields, including scientists, doctors, and others. However, one sector has clearly suffered the most from forced migration: the IT sector.

Let’s look more closely at Polish statistics. According to a survey conducted by the National Bank of Poland in 2024, 13% of Belarusians were employed in the “Information and Communication” sector — a share significantly higher than that of Ukrainians working in the same sector in Poland (2–3%).

If we compare this data with the number of Belarusian taxpayers, it shows that by the end of 2024, 17,500 Belarusian IT specialists were working in Poland. And this, of course, does not represent the full picture — many others have relocated to Lithuania, Georgia, and other countries.

The relocation of IT companies and professionals has had a negative impact on the Belarusian economy. While the number of IT specialists had been steadily growing until 2020, between 2020 and 2023, their numbers dropped by an average of 13,500. This mass relocation led to a decline in the IT sector’s share of GDP from 7.1% in 2020 to 4.5% in 2023. Although the IT sector has been gradually recovering since 2024, plans and ambitions to become a regional IT hub have been postponed for the foreseeable future.

Population Employed in the ‘Information and Communication’ Sector, Thousand People on Average per Year

Low Birth Rates and the Pension System Burden

The intensification of migration flows also negatively affects the birth rate. The majority of Belarusians who have emigrated are under the age of 44—people who are likely to start families or already have them. Many of their children will likely study and work abroad. As of August 2025, more than 20,000 Belarusians with permanent residency documents in Poland were under the age of 18.

At the same time, the demographic situation in Belarus remains challenging. Between 2020 and 2025, the country’s population decreased by 300,000. This figure likely does not include many of those who have emigrated. In 2024, there were 12.6 deaths and only 6.5 births per 1,000 people. The situation was worst in the Vitebsk region, where there were 14.8 deaths and only 6.1 births per 1,000 people.

Meanwhile, life expectancy has increased—a positive trend. In 2024, life expectancy reached 69.3 years for men and 79.8 years for women. However, this also means that the burden on the Social Protection Fund will grow in the future.

Because Belarus still operates a pay-as-you-go pension system, increasing life expectancy combined with low birth rates leads to greater pressure on the Social Protection Fund. The Fund is already subsidized by the state budget. As the population continues to age, the need for additional financial resources will increase, which will result in low pension levels. Currently, the average pension in Belarus falls below the minimum recommended by the International Labour Organization—40% of the average national wage. In 2024, this figure was 35%. The emigration of young Belarusians and their children further exacerbates demographic challenges and undermines the long-term sustainability of the pension system.

How Much Does Mass Emigration Cost Belarus?

It is difficult to calculate the exact economic effect of emigration over the past five years, but some conclusions can still be drawn.

For example, the number of Belarusians living and working abroad is greater than the entire population of Grodno, Vitebsk, or Mogilev. Most emigrants are of working age. Assuming ideal conditions, if 70% of emigrants—or about 280,000 people—had remained in the country and been economically active, that would be equivalent to roughly half of all employed people in the Gomel or Brest regions. In 2024, the gross regional product of these two regions totaled BYN 27.4 billion and BYN 28.7 billion, respectively.

Assuming ideal conditions, those 280,000 people could have generated an additional BYN 13–15 billion in value added to the economy, equivalent to approximately USD 4–4.6 billion.

To be clear, people are a critical—but not the only—resource required for GDP growth. Still, even based on these simplified estimates, it is clear that the emigration of Belarusians—combined with other structural problems—positions the national economy as one of missed opportunities.